The world economy remained resilient in 2024, expanding at a solid annualized rate of 3.2% during the second half. However, recent activity indicators point to a weakening of global growth prospects. Business and consumer confidence has weakened in some countries. Inflationary pressures persist in many economies. At the same time, political uncertainty has been high and significant risks remain. Greater fragmentation of the world economy is a key concern. Higher-than-expected inflation would drive more restrictive monetary policy and could lead to disruptive revaluation in financial markets. On the positive side, agreements to reduce tariffs from current levels could generate higher growth.

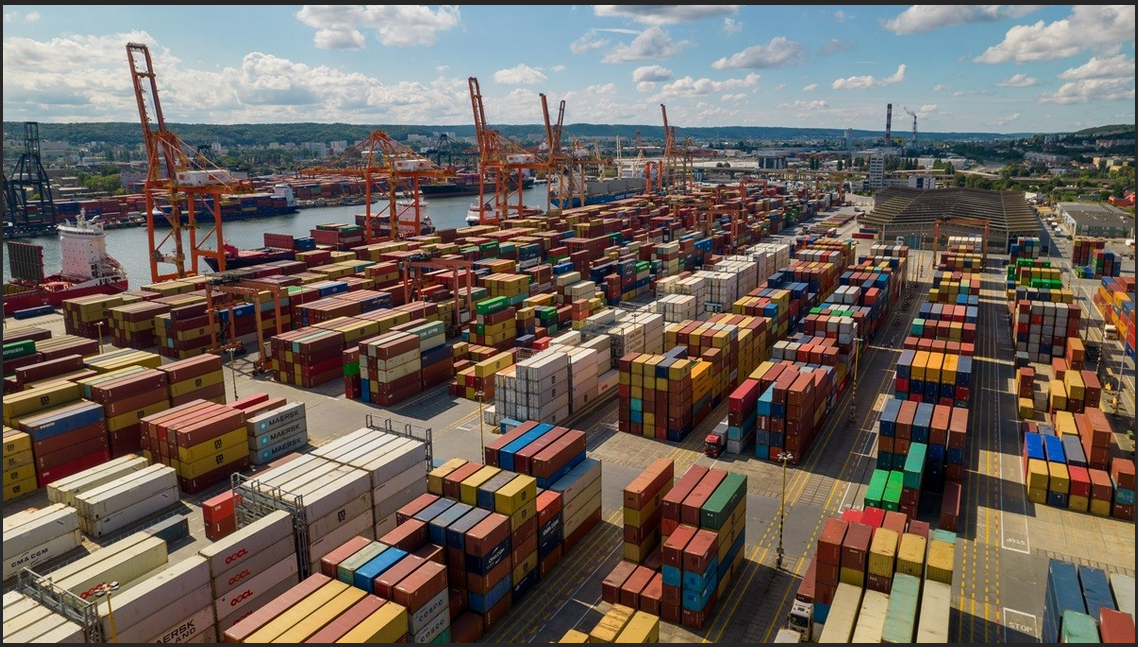

Global trade reached a record $33 trillion in 2024, with growth of 3.7% ($1.2 trillion). Most regions experienced positive growth, except Europe and Central Asia. Services led the expansion in 2024, with annual growth of 9% and a contribution of $700 billion (almost 60% of total growth). Goods trade grew at a slower rate of 2%, contributing $500 billion. However, growth in both sectors slowed in the second half of 2024: services grew by only 1% and goods less than 0.5% in the fourth quarter. Trade in developing economies grew faster. Their imports and exports increased by 4% annually and 2% in the fourth quarter, driven mainly by East and South Asia. Meanwhile, developed economies experienced stagnation in their annual trade and a 2% decline in the fourth quarter. Merchandise trade imbalances widened. The US trade deficit with China reached -$355 billion, increasing by $14 billion in the fourth quarter, while the US deficit with the European Union increased by $12 billion to -$241 billion. Meanwhile, China’s trade surplus reached its highest level since 2022. The EU reversed previous deficits, recording a trade surplus for the year.